Source: J.P. Morgan Asset Management. All above data as of December 31, 2024.

Experience the Future of Liquidity Trading with Morgan Money

Why Choose Morgan Money?

1. Accessibility and Integration

- Open Architecture: Gain unbiased access to a diverse range of investment solutions, ensuring you have a wide variety of options at your fingertips.

- Seamless Integration: Effortlessly connect on a global scale with SFTP or over 25 APIs, making your trading experience smooth and efficient.

- Mobile Trading: Stay connected and trade on-the-go with the Morgan Money Mobile app, providing flexibility and convenience wherever you are.

2. Analytics and Reporting

- Insightful Analytics: Dive deep into risk analysis and fund comparisons, empowering you to make informed investment decisions.

- Real-Time Reporting: Access on-demand, customized reports for timely insights, keeping you ahead in the fast-paced trading environment.

- Rules-Based Investing: Automate cash optimization across multiple currencies, streamlining your investment strategy.

3. Performance and Customization

- Streamlined Workflow: Experience fast execution with nine trading methods, enhancing your trading efficiency.

- Robust Infrastructure: Benefit from over 99% uptime and strong cybersecurity, ensuring a reliable and secure trading platform.

- White Labelling: Customize platform solutions to reflect your brand, offering a personalized experience for your clients.

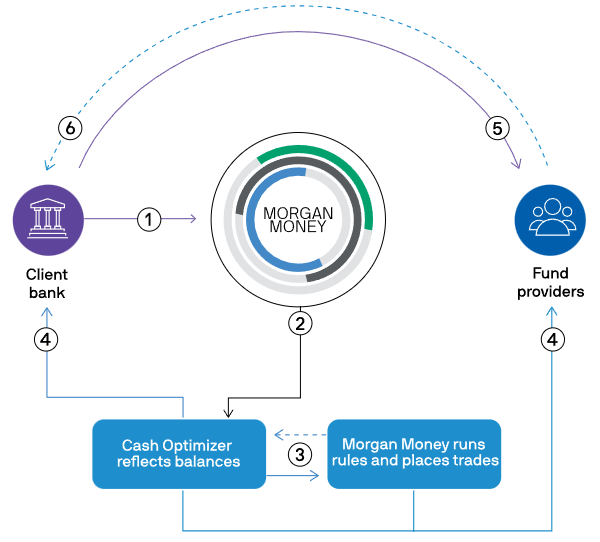

Optimize Cash Management with Morgan Money

Exclusively on Morgan Money

- Set Rules: Define allocation rules for your DDA balance.

- Automated Execution: Automatically manage balances, execute trades, and transfer funds.

- Complete Oversight: Receive notifications and confirmations for full control without requiring manual action. Morgan Money’s Cash Optimizer ensures efficient, automated cash management tailored to your needs.

Discover how Morgan Money can streamline your workflow, provide real-time insights, and empower smarter cash management decisions. Experience the power of open architecture, seamless integration, and robust analytics – all in one dynamic platform.